We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

Steel Mesh Prices in July 2021

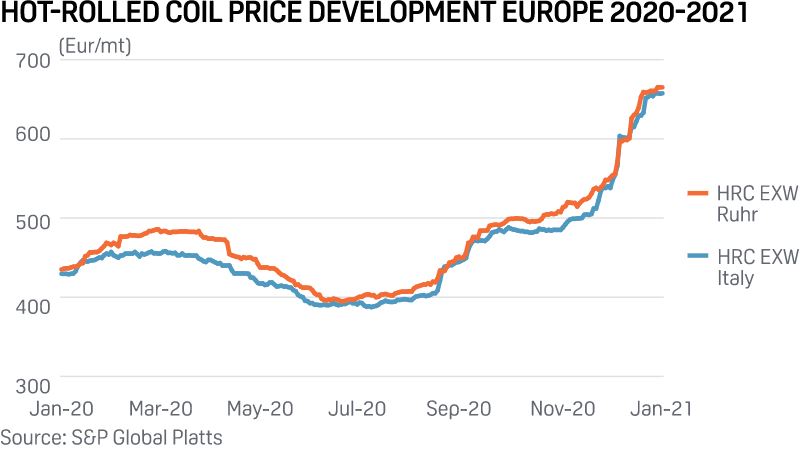

Few in the construction sector and related industries will be unaware of the recent price volatility affecting global steel markets currently. Whilst 2020 was undoubtedly a turbulent time for many sectors, 2021 has very definitely picked up the pace, with steel prices fluctuating wildly, and on an almost daily basis throughout June and July. For construction firms of all sizes, this is making life extremely difficult, and both costings and build planning are being subjected to extreme pressures. In this article, we aim to shed some light on some of the reasons behind this extreme volatility in the steel market, and then give our thoughts on when things are likely to stabilise.

A Problem For The Entire Construction Industry

One of the first things to note is that the problems affecting the steel markets are also affecting many other sectors across all areas of construction and manufacturing. Price hikes and long delays are being seen in the timber industry too, with prices rising by up to 150% during 2021. Poured concrete is also being subjected to similar pressures, leaving some customers with deliveries that don’t match ordered volumes, and creating huge problems at the point of construction. Even internal fixtures and fittings are coming under fire, leaving end users just as frustrated as construction firms.

Why Are Mesh Prices Moving So Dramatically?

So what are the root causes of this squeeze on supply and its resulting price pressure? Of course, the global Covid-19 pandemic has a huge part to play in explaining what is going on. As the UK pulls itself out of the grips of spiralling infection rates, it becomes easy to forget that other places around the world are still struggling to contain the virus. India and Brazil have had a particularly gruelling time during 2021, and China continues to impose extremely strict lockdowns whenever a local spike in infection rates is detected. Here in the UK, it might feel like things are slowly getting back to normal, but across the world, things are very different indeed.

Covid-19 has disrupted a global supply chain that was previously fairly smooth. Lockdowns and staff shortages caused by infected employees have meant that around the world, raw materials have been blocked from export or import, goods have stacked up in ports and empty containers have not made their way back to where they are needed. It seems incredible, but there is actually a global shortage of shipping containers currently, and shipping costs from China to the UK have, in many cases, tripled in the past few months.

Production levels of manufactured goods and materials are also under intense pressure. Whilst output has been reduced, or sometimes stopped entirely for months on end, demand has continued apace, and in many instances, has actually increased, as furloughed staff decide to take on a home improvement project or do some DIY to fill up their time, and governments around the world decide to invest in huge infrastructure projects to build their way out of a potential future recession. With increased demand and reduced supply, it was inevitable that steel mesh prices would rise. In terms of steel in particular, China’s apparent reluctance to boost output certainly isn’t helping matters.

It’s More Than Covid-19

Leaving Covid-19 aside for a moment, there are a number of other issues at play that could be making a bad situation worse. Confusion around Brexit legislation may have caused some volatility as overseas suppliers exporting to the UK pushed up their prices to offset perceived additional costs in getting their goods into the UK. The EU’s import quotas, established in 2019 as a backlash against Donald Trump’s US tariffs on steel, probably haven’t helped either. With the UK considering revoking those import limits now that we are no longer a member of the EU, there may be some downward pressure on steel prices on the horizon. However, this isn’t necessarily good news for the UK’s own steel producers, as they will come under intense pressure from cheap imports from countries where production costs, and in particular energy costs, are much lower.

As if the factors outlined above weren’t enough to send markets into a spin, there are yet more things that have had an impact on supply and prices. These may be smaller, but cumulatively, they all pile on just a little bit more pressure. When the massive container ship, the Ever Given, got stuck in the Suez Canal in March this year, we all giggled about how such a thing could happen, but few realised just what a long knock-on effect it would have on container shipping. A backlog of over 400 ships soon built up and it took weeks to get things moving again. With raw materials and manufactured goods already suffering long delays due to weak supply, this has simply added fuel to the fire. Even HS2 is playing its part, with the project making huge demands on the UK’s concrete industry, including steel reinforcement products such as mesh fabric.

What’s In Store For Steel Mesh Prices Going Forwards?

All of the elements outlined above have combined in recent months to create the perfect storm, forcing suppliers to constantly change their prices to reflect their own wildly fluctuating costs. Of course, this is not ideal for either customers or suppliers, and it has given rise to a great deal of uncertainty and frustration within the steel industry.

We’ve worked hard to maintain robust supplies of our steel reinforcement products, we are doing everything we can to mitigate against the current steel price volatility, and we do genuinely believe that there is light at the end of the tunnel. We buy in bulk and maintain stock of steel mesh, to reduce the impact of these constant fluctuations. Some of the pressures we’ve highlighted in this article are more temporary than others, and steel-producing countries around the world are ramping up vaccinations and slowly getting back to full capacity. The global shipping crisis will soon start to ease a little, as lockdowns are lifted and shippers are able to move their fleets around again with relative ease. Even the initial import and export confusion thrown up by Brexit seems to be subsiding, with European trade showing small but tangible signs of getting back to pre-Brexit levels. If we’ve learned one thing over the past few months, though, it has been to hold on tight, because the road isn’t a smooth one just yet.